Advario is a leading global player in the energy storage industry. Sustainability is at the heart of all its activities and aligned with shareholder objectives. The company has ambitious growth objectives, and the M&A Manager works on M&A and strategic projects end-to-end. This is an exciting opportunity for an experienced M&A manager to drive the company’s growth in the years to come.

About Advario

Advario is a global player in the energy storage industry with an ambitious growth strategy. The company was carved out of Oiltanking GmbH and aims at playing a critical role in the energy transition by embedding ESG and sustainability across its entire operation. Since 2022, there is greater momentum for the energy transition than ever before, and Advario feels the responsibility of ensuring that energy is both made available and decarbonized at the same time.

Advario is serious about making a positive impact. The company has a clear strategy to protect the environment, reduce waste and make a positive contribution to society. They aim to use energy and raw materials efficiently, avoid environmental pollution, promote awareness among their employees and drive impact along the value chain. Their three strategic pillars are to be Net Zero by 2040 latest, to earn sustainable revenues from new non-carbon products and renewable fuels, and to improve communities through CSR programs and employee volunteering. Their ambition to double its business by 2030 while still adhering to these values is at the core of Advario’s DNA.

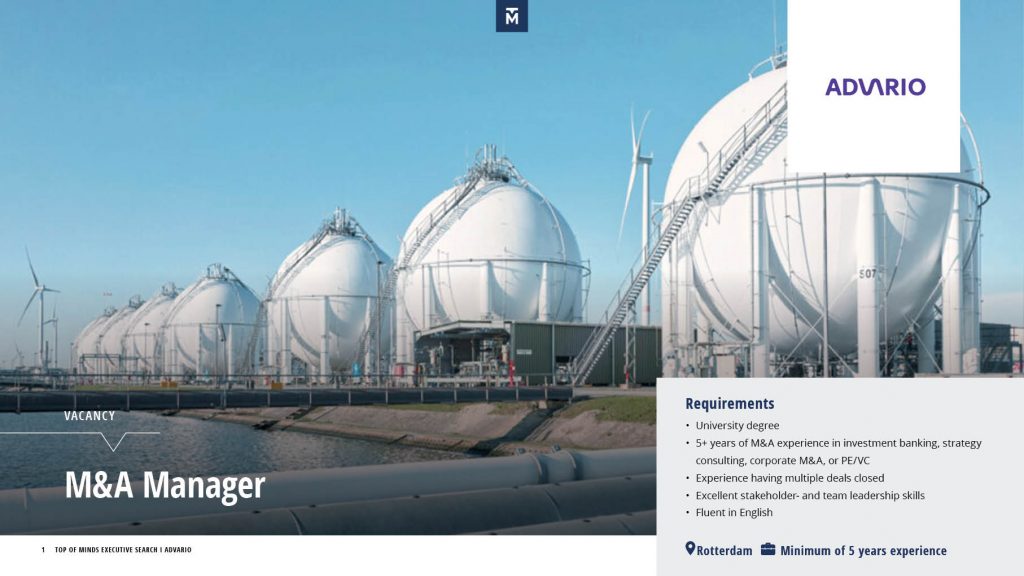

Advario is headquartered in Rotterdam, the Netherlands, and operates 13 terminals in Europe, China, Singapore, Middle East, and the United States. The company takes a focused and collaborative approach, together with its partners across the industry, to find storage and logistics solutions. Building on 50 years’ family-owned business history, Advario consists of a team of 1,200 experts from all around the word.

“ESG is at the heart of all our activities and aligned with our shareholder objectives. Advario is a portfolio company of privately-owned Marquard & Bahls, whose vision it is to be a leading ethical investor in the energy sector.” – Bas Verkooijen, CEO

Vacancy: M&A Manager

Advario is building up its Strategy, Portfolio & Sustainability team, which is dedicated to realizing the company’s ambitious growth objectives through market consolidation and strategic partnerships. The M&A Manager works end-to-end on these M&A deals and on strategy projects. For this role, the ability to hit the ground running is essential. Shortly after joining, the M&A Manager will already be engaged in ongoing M&A transaction, meaning that both strong team leadership skills and a natural authority with stakeholders is essential.

Overall, the M&A Manager is responsible for identifying, selecting, and assessing potential acquisition targets, in cooperation with Business Development, and to execute M&A and JV projects end-to-end. This includes the coordination of all due diligence activities internally and externally (via advisors), the development of the valuation and business plan, the contract negotiations, and local PMI support. In addition, the M&A Manager supports the development and improvement of M&A processes and tools. With the Strategy, Portfolio & Sustainability team consisting of 8 FTE, the M&A Manager has a lot of responsibility from the beginning, reporting directly to the team’s Senior Vice President.

“Shortly after joining, the M&A Manager might already be on the way overseas to pick up and lead an ongoing M&A transaction. They have the responsibility, and lead and execute from a to z.” – Roderic Heeneman, Senior Vice President of Strategy, Portfolio & Sustainability

This is an excellent opportunity for an experienced M&A manager with strong leadership skills to join a global energy storage company and drive its growth into new and more sustainable operations in the years to come. Also, the role offers interesting growth perspective, as the M&A Manager can further develop in the M&A domain, move to the Strategy or BD team, or into a role at one of the terminals or newly acquired companies.

The role of M&A Manager is based in the headquarters in Rotterdam. At the same time, the company offers significant flexibility in terms of working location (onsite/from home) and working hours.

Interested?

This client works with Top of Minds to fill this vacancy. To express your interest, contact Imke Peters at imke.peters@topofminds.com